property tax assistance program montana

What You Should Know About the Montana Property Tax Relief. For more information about qualifications or to download an application form visit.

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

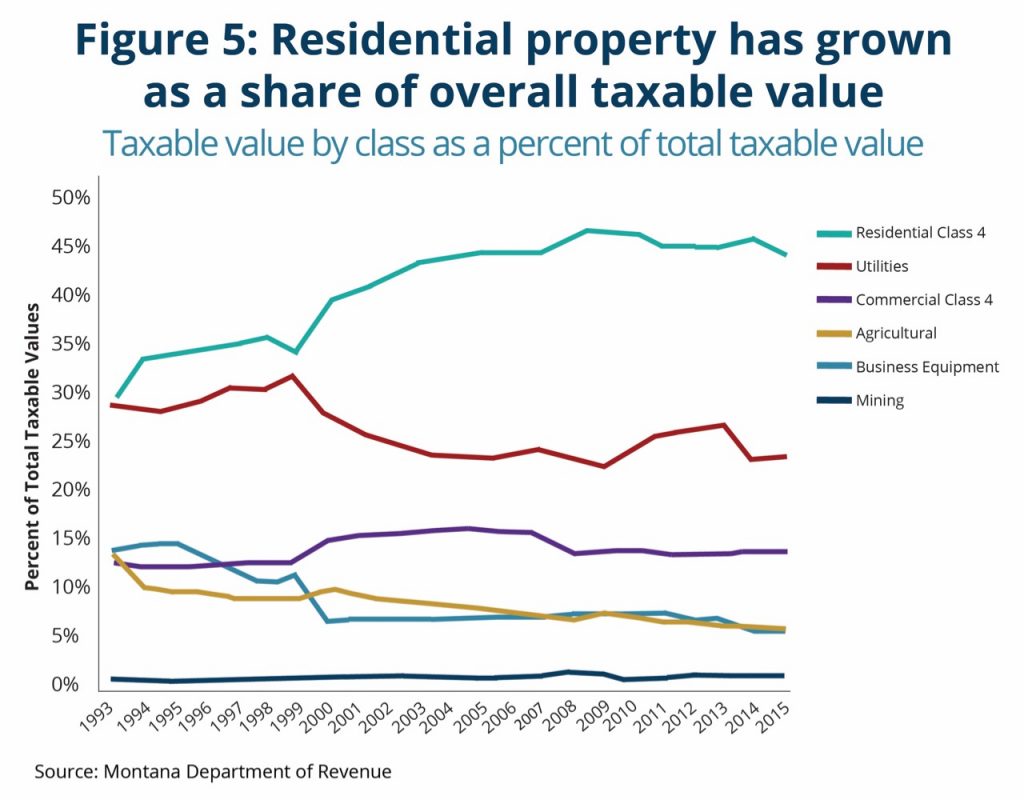

The market value of all residential commercial and industrial real property every two years.

. MT QuickFile is for filing a. The Montana property tax system provides support for local public services including funding for schools roads and other infrastructure. PTAP provides this assistance to these individuals by reducing the property tax rate that is on the.

56107 for married or head of household. 4219401 PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM 1 The property. July 2 2021.

Montana law includes four programs to offer property tax assistance to residential property taxpayers. The department is statutorily required to determine. A Benefits Enrollment Center BEC can offer you personal one-on-one assistance as you navigate program eligibility and look to apply.

With support from the National Council on Aging. Montana Disabled Veteran Property Tax Relief Application Form MDV 2022. Download or print the 2021 Montana Form PTAP Property Tax Assistance Program PTAP Application for FREE from the Montana Department of Revenue.

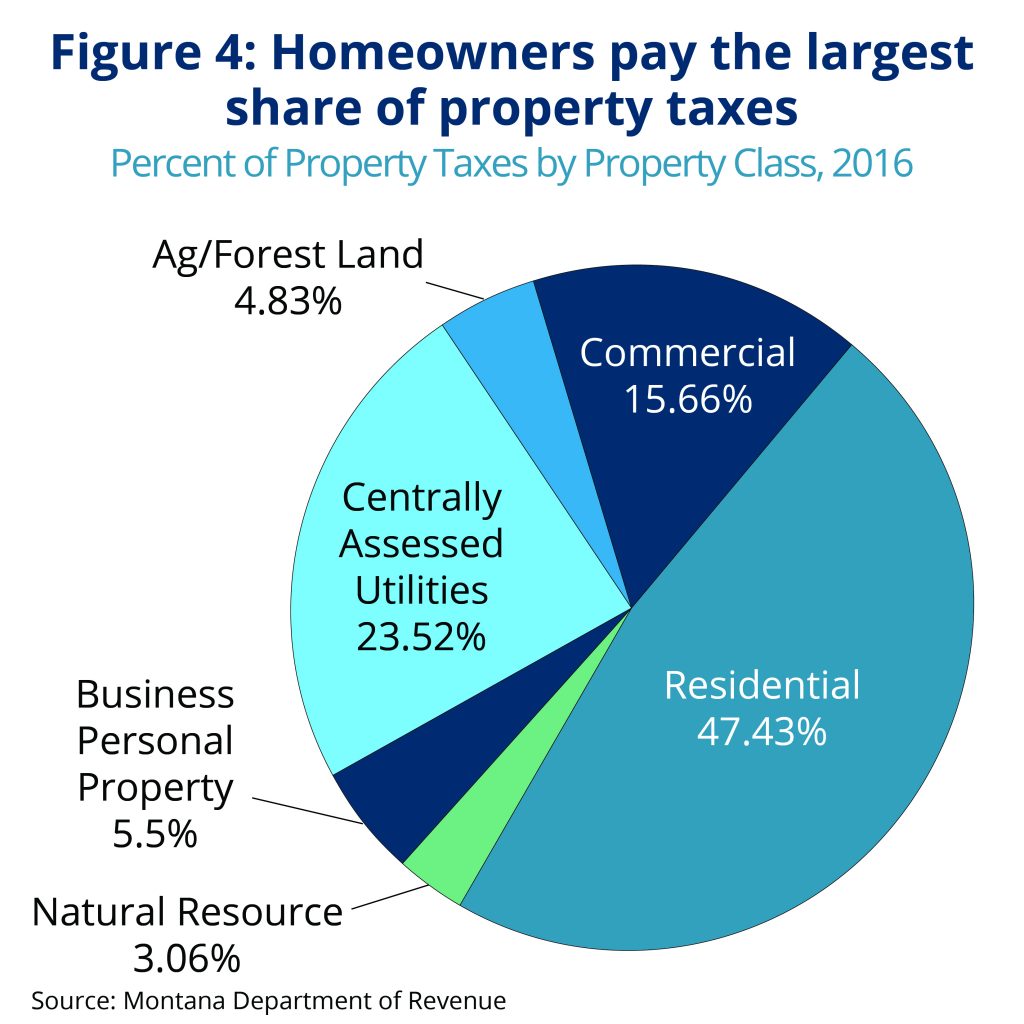

The property tax assistance program for those with a fixed or limited income and the property tax assistance program for disabled veterans are provided for in. Two of the programs are reductions in taxable value one is an exemption for the. Residential property owners pay.

Adoption Notice PDF 20 KB Proposal Notice PDF 48 KB. January 1 2020 is the valuation date. PTAP is designed to assist citizens of Montana who are on a limited or fixed income.

The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of. Title 15 chapter 6 part 3.

Area VI Agency on Aging can help. Qualifying for this program may reduce your property tax. Property Tax Assistance Programs.

The Land Value Property Tax Assistance Program for Residential Property LVPTAP helps residential property owners if the value of their land is. For an unmarried surviving spouse your income needs to be less than 42392. Financial assistance in the form of a grant to prevent property tax foreclosure or remove or prevent creation of other liens HOA COA etc.

Income limits are 48626 for a single person. Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax. Property tax assistance program -- fixed or limited income.

The Montana Disabled Veterans MDV Assistance Program helps disabled veterans or their unmarried surviving spouse by reducing the property tax rate on their home. Search Query Show Search. The taxpayer must live in their home for at least seven months out of.

Montana State Tax Software Preparation And E File On Freetaxusa

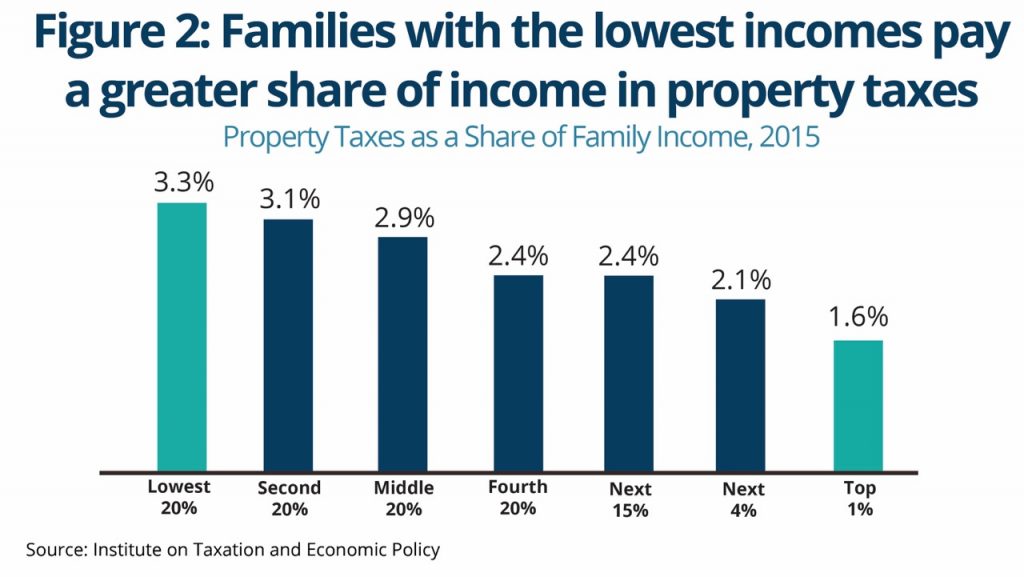

Policy Basics Property Taxes In Montana Montana Budget Policy Center

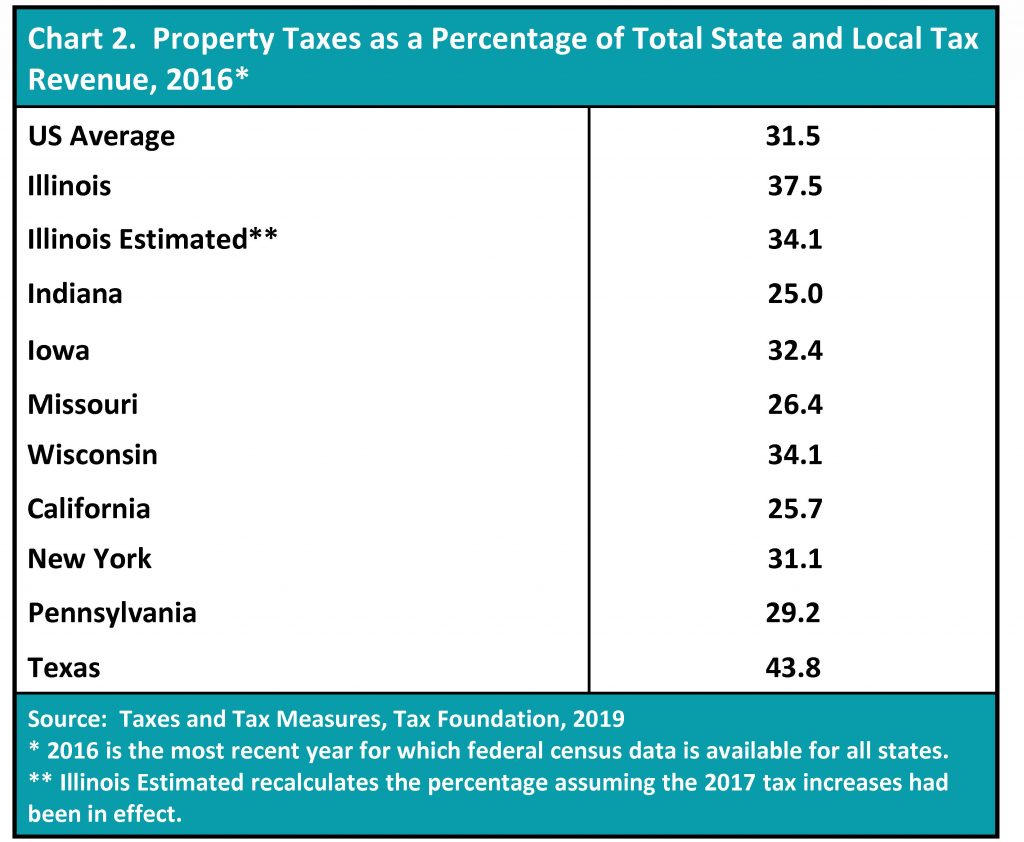

Taxpayers Federation Of Illinois A New Property Tax Relief Tax Force Same Old Problems Mike Klemens

Private Property Rights Articles

Montana State Taxes Tax Types In Montana Income Property Corporate

Tax Assistance Mercer County Library System

Finance Department Livingston Montana

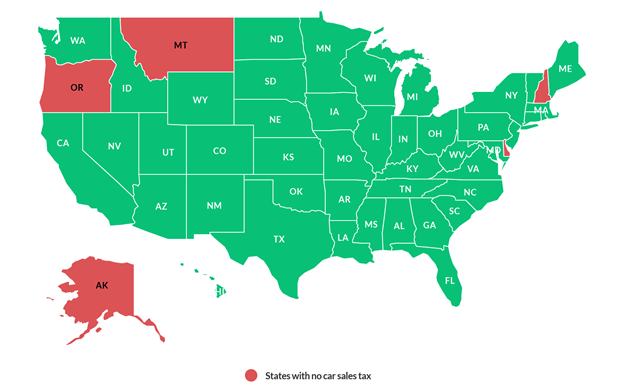

Is Buying A Car Tax Deductible Lendingtree

Ci 121 Montana S Big Property Tax Initiative Explained

Taxes Fees Montana Department Of Revenue

Policy Basics Property Taxes In Montana Montana Budget Policy Center

Montana Income Tax Information What You Need To Know On Mt Taxes

Property Taxes Urban Institute

Property Tax Help Montana Taxed Right Consulting Llc

First Time Homebuyer Programs In Montana Newhomesource

Policy Basics Property Taxes In Montana Montana Budget Policy Center

Tax Breaks For Montana Property Owners Inspect Montana

Tax Tip Montana Property Tax Assistance Program Tax Tip Tuesday Kulr8 Com

How Do State And Local Property Taxes Work Tax Policy Center